Chapter 6

Things to consider when choosing your remote work compensation policy

Now that you have learned about the three main types of remote compensation strategies, it’s time to decide which of these will work best for your company.

There are many factors that could influence your decision, each of which could fall under one of three main categories:

Considerations based on values

Considerations based on finances

Considerations based on legal requirements

The best remote work compensation policy for your company will occupy the intersection of these three – what we can call, the compensation sweet spot.

Considerations based on company values

A successful compensation strategy aligns with a company’s values. Alex Wilson-Campbell says,

“Aligning the compensation strategy to values and goals is probably top of my list in terms of best practice.”

Alex Wilson-Campbell, Founder & Host of Remote Work Life podcast

When a pay strategy aligns with the values and culture of a company, it can help strengthen the company’s culture and exemplify its values, rather than take away from them.

Your decision about which strategy to choose can also be made easier when you identify the strategy that best aligns with your company’s values. One of SafetyWing’s values is that “Simpler is better.” Their CEO Sondre Rasch says they applied this value when they were crafting their pay strategy. He states, “Our compensation policy is remarkably simple…Simplicity is relevant for us in our product. One of the great things we supply to the world of insurance products is simplicity…But we also implemented [simplicity] in our compensation policy. When we first started out, we devised our compensation policy that we still have to this day, which is a flat base salary. So everyone in the company has the same salary.”

Considerations based on finances

A key factor when crafting your remote compensation strategy is the question of affordability. Which pay strategy can you afford? In an ideal world, a company can always afford to offer pay rates on the higher end of the current market’s salary range, to attract strong candidates and retain employees. However, this isn’t always the case. You’ll need to consider the following factors for any pay strategy you choose:

Headcount - How many employees do you currently have, and what roles will you be hiring for in the near future and further ahead? How much should you budget for their salaries and overall compensation packages?

Promotions and raises - For your current and future employees, how often will you be adjusting their salaries, due to promotions, cost-of-living adjustments, or other changes? How does that affect your overall budget?

Employee locations - Where are your current employees located, and what locations might you hire from in the future? If you’re considering using location-based salaries, how do these locations affect your overall budget? You’ll need to think about what employer taxes you’ll need to pay in each location, as well as what salaries are competitive in local markets. If you’re considering using a location-agnostic approach, what market will you benchmark from, and how will that affect how competitive you are in the markets where you want to hire? Kevin Kirkpatrick says, “When you go remote, salary bands have to be ten to twenty percent wider just to accommodate for cost of living changes and legal or cultural differences.” Ali Greene recommends planning out what markets you’ll want to hire in at least one to three years ahead, so that you can think through “at least one round of hiring [and] at least one round of promotions.”

Company growth - How much do you expect your company to grow, in terms of its finances, in the coming years, and how does that affect what pay strategy you can afford?

Considerations based on legal requirements

In addition to values and financial considerations, you’ll need to look at the laws you must comply with. Hiring within the US presents different complexities when compared to hiring in Germany, for example, and you’ll need to take these into account when creating your remote work compensation policy.

Legal considerations are arguably the most straightforward factors companies must consider when determining pay. Unlike those involving fairness and pay inequity, the legal requirements that companies need to comply with are, at the very least, public knowledge, and often come with a set of actionable steps. For example, US-based companies that hire across multiple states need to be registered as a multi-state employer and will have to take federal as well as state employment laws into account when they do their payroll.

When crafting a remote compensation policy, you’ll want to make sure that it complies with the local laws for all of your remote workers (and for any workers you want to hire in the future). As Kevin Kirkpatrick recommends, you should ask, “What are the laws and regulations in each regioin? Are there considerations that need to be accounted for that might offset the pay structure you have in place?”

“What are the laws and regulations in each region? Are there considerations that need to be accounted for that might offset the pay structure you have in place?”

Kevin Kirkpatrick, We Work Remotely

Do your research by reviewing the employment laws of each applicable country and locality and seeking the help of HR and local experts.

Additional financial considerations

When it comes to creating a pay strategy for remote teams, you’ll also need to consider these special factors:

Benchmarking data is different for remote roles

Figuring out salary data for roles where there’s no data

Paying in USD vs. local currency

Gross salary vs. cost of employment

Stock options for remote teams

Giving international team members an equitable payments experience

Benchmarking data is different for remote roles

When you hire remotely, you can’t rely on local salary data. Because remote workers are part of a worldwide job market, their salaries are typically higher than those for people in similar roles working for local companies. As Kevin Kirkpatrick says,

“As you go global, a lot of your competitive landscape flattens out. New companies become your competitors for talent.”

Kevin Kirkpatrick, former CEO at We Work Remotely

It doesn’t necessarily mean you’re competing with San Francisco salary rates, but the salaries you offer will need to be higher than local ones. Where can you find reliable salary data? Sources like Radford or Pave (which acquired startup compensation database Option Impact in 2022) are popular. There are also free tools like Salary.com and Plane’s own remote salary database, which specializes in salaries for remote workers. With all these sources, keep in mind that, unless they are specifically for remote salaries, if you’re looking at local market data, they will likely be lower than what remote workers in those areas actually earn.

No matter what salary database you’re using, remember to take into account currency exchange rates and the potential for currency fluctuations when you’re benchmarking salaries for international employees.

Figuring out salary data for roles where there’s no data

What if you want to hire in a location where there’s no market data for a specific role? One technique for calculating a fair salary when you don’t have market data is to pick four roles with data that you do have for your target market. Pick another market with data for those same four roles – plus the role that you’re hiring for. Compare those four salaries to the market you’re looking at. You can use the percent difference in salaries between each role in the two locations to determine what the salary for the role you want to hire might be.

For example, let’s say you want to hire a product marketer in Poland, but you don’t have market data. In this case, you can take four roles in San Francisco (e.g., React Engineer, Product Manager, Head of HR, and Accountant), compare them to the same roles in Poland, and average out the salary differences to determine, based on the San Francisco salary for a product marketer, what the salary might be for the same role in Poland.

Paying in USD vs. local currency

With an international team, you’ll need to determine whether you want to pay salaries in USD or team members’ local currencies. If you pay an employee’s salary in USD, this means that they will have to risk their salaries changing every month, depending on what the current conversion rate is from USD to their currency. If you pay the salary in their local currency, then the risk is on the company’s side, in terms of how much you need to pay the employee each month based on conversion rates from USD. Many companies give their team members the option to choose between having their salaries set in USD or local currency; you can show the employee the two different numbers, and just let them choose. (This is what Plane offers to our own employees.) In this case, we recommend limiting how often the employee can switch between the options. At Plane, for example, employees can switch once a year. This helps limit the work and time involved with changing the currency.

Note that you can set salaries in USD while also paying employees in their local currencies (also known as pegging salaries to USD). For example, you can set a salary of $80,000 for an employee, and give them the choice of being paid in USD or in their local salary. This is another option that Plane offers to our own employees (and to companies that use Plane to pay their team members).

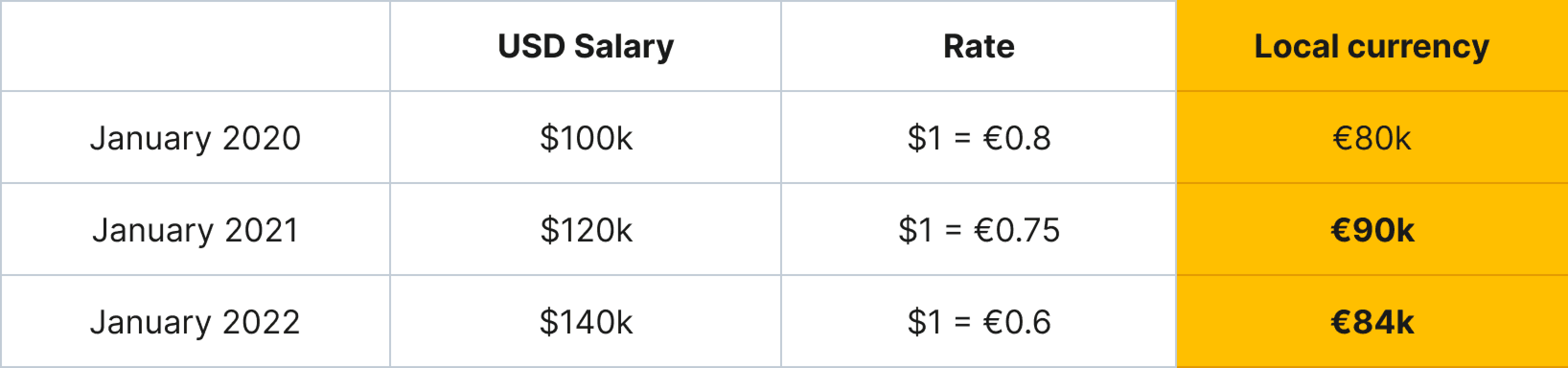

One caveat when it comes to paying employees internationally is to make sure you aren’t inadvertently paying employees less over time, due to currency rate fluctuations.

For example, in January 2020, an employee earning $100,000 was earning €80,000. Due to fluctuations in USD to Euro exchange rates, even if the employee received a raise to $140,000 in January 2022, that would be worth only €84,000. To prevent this from happening, you can state in your remote work compensation policy that employees will never get a salary decrease due to currency rate changes.

Gross salary vs. cost of employment

When determining your pay strategy, you’ll want to decide whether your approach is based on gross salaries or cost of employment. For example, if you want to pay your engineers $100,000 each in gross salary, the total cost of employment for each of them will differ, depending on employer taxes in their country. In the US, a $100,000 gross salary will result in $19,000 in employer taxes, while the same salary will cost $32,000 in employer taxes in Brazil.

If you decide that you want to pay the same cost of employment for each engineer, then that means you could pay a gross salary of $100,000 for the US engineer and $90,000 for the Brazilian engineer, resulting in a cost of employment of $119,000 for each of them.

You may encounter a similar issue when hiring employees and contractors in the same country. For example, if you want to offer the same gross salary of $100,000 each to a contractor and an employee in Poland, the cost of employment for the contractor will be $100,000 (because you don’t need to pay employer taxes), while the employment cost for the employee will be $126,000, including employer taxes. If you wanted to spend the same cost of employment on each role, then the contractor would earn $126,000.

Whether you choose to base your pay strategy on gross salary or cost of employment, you’ll want to include which approach you use in your remote compensation policy, to help your team members understand how their pay is determined. As Remote Works’ Ali Greene says, “Removing those layers of complexity and explaining [your approach] to employees to justify how their take-home pay is being determined” is important. She states that such clear communication is about “exposing those nuances early on and having a very objective answer to each nuance that is brought up [e.g., by employees]. That is what makes a successful compensation strategy at the end of the day.”

Stock options for remote teams

In our experience, companies typically do not have location-based stock option plans, even if their remote pay strategy is location-based. Usually, for example, all engineers get the same stock option package, even if their salaries are adjusted by location. You’ll want to double-check whether there are any local laws related to stock options, wherever you’re hiring.

Giving international team members an equitable payments experience

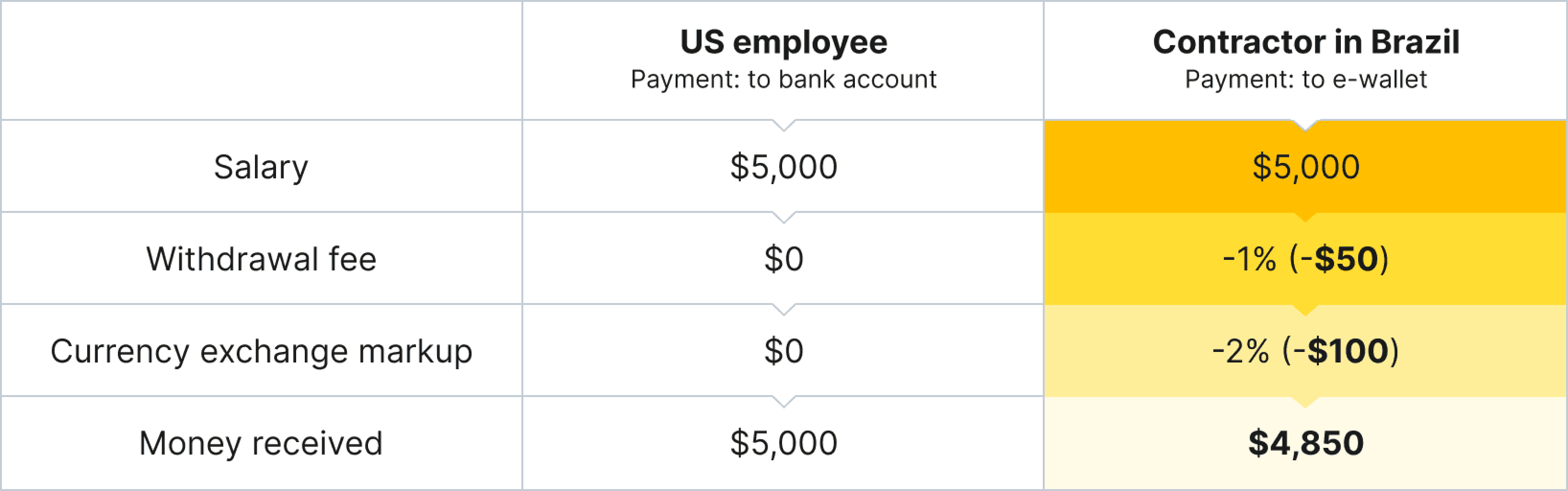

Whichever pay strategy you choose, you’ll need to take note of the payment method you use to pay your international team members. If you want to pay the same amount to a US team member and to an international one, the international one will often receive less than the US team member, because of currency exchange markups and transaction fees. This can lead to an inequitable payment experience for your international team member.

For example, let’s say you want to pay $5,000 each to a US employee and to a contractor in Brazil. The US employee will just receive the $5,000 in their bank account. Depending on which payroll platform or method you use, the Brazilian contractor will likely first have the $5,000 payment sent to an e-wallet. To withdraw the payment, they will need to use a money transfer service like Wise or PayPal, that will charge a withdrawal fee. Then, if they want to convert the money into their local currency, they will likely be charged a currency exchange markup. Altogether, they could end up receiving $4,850 instead of $5,000.

To prevent this from happening, do your due diligence when deciding which global payment platform to use, so you understand if there are any fees or markups for payments to your international team members. (And if you’ll allow our plug: Plane supports treating all team members equitably, and our platform never makes money from exorbitant currency exchange rates.)

Next Chapter

Which remote pay strategy is right for you?

Choosing the right remote pay strategy depends on a number of factors. Which strategy, then, should you choose, and how should you create and launch your strategy?