Table of Contents

Loading headings...

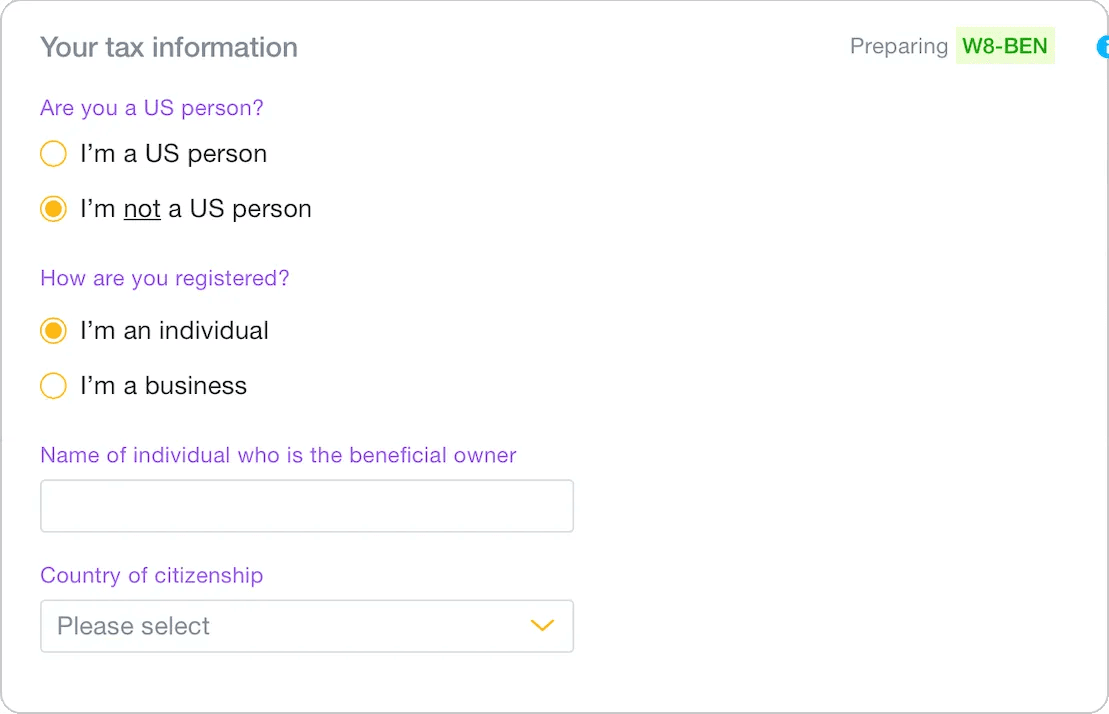

Plane now collects W-8 (BEN and BEN-E) and W-9 forms from your contractors directly in the platform. Contractors can fill out W-8 and W-9 forms in Plane and receive guidance within the platform wizard as they complete their forms, or they can upload their signed forms, if they prefer. This feature makes the form completion process for contractors much faster and more streamlined

W-8 (BEN and BEN-E) Forms 📝

Non-US citizens and non-US organizations performing services for US-based entities are required to complete W-8 forms and submit them to their payers.

There are two versions of the W-8 form: The W-8BEN is for individuals, and the W-8BEN-E is for organizations (e.g. corporations, limited liability companies, etc.). If a contractor works as a sole proprietorship, they are still considered an individual and should complete a W-8BEN form.

To complete your W-8 form:

Go to the Compliance tab and select ‘A recent W-8 or W-9 form confirming your U.S. tax status.’

If you would like to upload a signed W-8BEN or W-8BEN-E form, select ‘Upload a signed form instead’ in the upper right-hand corner. Choose your form type, and then choose the file you’d like to upload. Please note that the file needs to be in PDF format. Then, click ‘Upload document.’

To complete the form in the platform, enter your information in the ‘Your tax information’ section. Please see below for more detailed instructions. Sign the form with your full name, and click ‘Sign and submit.’

After you submit your form, your company administrators and assigned manager will receive a notification by email that the form was submitted. If you would like to view your form, go to Your profile. In the Documents section, you can click your completed form to view it.

Note: The form is valid for three years (until the end of the year) after you submit it. However, we’ll be asking you to complete it once a year to make sure it has up-to-date information.

For more information, see our help article on How to complete W-8BEN and W-8BEN-E forms.

W-9 Forms 📑

All US citizens or other US persons (including resident alien individuals) performing services for US-based entities as independent contractors are required to complete a W-9 form and submit it to their payer.

To complete your W-9 form:

Go to the Compliance tab and select ‘A recent W-8 or W-9 form confirming your U.S. tax status.’

If you would like to upload a signed W-9 form, select ‘Upload a signed form instead’ in the upper right-hand corner. Select the W-9 form type, and then choose the file you’d like to upload. Please note that the file needs to be in PDF format. Then, click ‘Upload document.’

To complete the form in the platform, enter your information in the ‘Your tax information’ section. Please see below for more detailed instructions. Sign the form with your full name, and click ‘Sign and submit.’

After you submit your form, your company administrators and assigned manager will receive a notification by email that the form was submitted. If you would like to view your form, go to Your profile. In the Documents section, you can click your completed form to view it.

Note: The form is valid for three years (until the end of the year) after you submit it. However, we’ll be asking you to complete it once a year to make sure it has up-to-date information.

For more information, see our help article on How to complete a W-9 form.

Want product news & updates?

Sign up for our newsletter.