Estimated reading time: 7 mins

Portugal Employment Laws: A Guide for US Companies

In recent years, an increasing number of remote workers have been drawn to Portugal. With its strong tech industry, the country is an ideal place for US companies to look for remote tech workers. We walk through the key employment laws to keep in mind if you're hiring there.

Caitlin MacDougall

PEO vs EOR: What are the Differences and Which is Right for You?

Read Story →

A Guide to the Best Remote Work Tools for HR Teams

Read Story →

How to Manage a Remote Team: 6 Ideas for Better Remote Work

Read Story →Portugal is a great place for remote working, with its low cost of living, stunning beaches, and gorgeous weather. US companies also may be attracted to Portugal as an ideal place for building an international team in Europe. Not surprisingly, companies in the tourism and hospitality industries do well in Portugal, but your company will be well positioned for success if you're in the tech industry, too. Tech accounts for almost 10% of the country's GDP, and the startup scene is booming in Lisbon.Before you start hiring in Portugal, you may wonder about the employment rules and regulations that govern the employment relationship between employers and workers there. In this article, we will provide an overview of Portuguese employment law, including employment contracts, mandatory benefits such as sick pay and parental leave, and working conditions in Portugal.Let's start with employment contracts.

Employment contracts📑

As a general rule, employment contracts must be in writing if they are fixed-term contracts of employment, contracts of indefinite duration, short term, or part-time contracts. In written contracts, the employer must include identification of the employer and worker in the worker's contract, as well as the starting date and location where the work is to be performed. The contract must also include the worker's duties and expectations for how the work is to be performed, the method and frequency of their salary, and the termination agreement, if any. Details of the worker's benefits may also be included in the contract.Fixed-term contracts

Employees hired under fixed term contracts work for a specific duration. The minimum duration for these contracts is six months, and the maximum duration is three years. Typically, an employer will implement this type of contract when replacing a worker for a short amount of time, such as in the case of maternity leave. An employer may also use these contracts when a company needs a single project completed, or when a company requires seasonal work.Contracts of indefinite duration

Contracts of indefinite duration do not have a specific end date, and do not relate to any temporary need of a company.Short duration contracts

Short duration contracts are often used for hiring agricultural workers or those who work in the tourist industry. This type of contract is suitable for irregular seasonal work, when there is a period of increased work activity at a certain point(s) in the year. The work period may not last for more than 35 consecutive days, and may not exceed 70 days in a calendar year.Part-time contracts

A part-time contract is a written agreement that is appropriate for employees who work less than a full-time schedule. The maximum percentage of full-time hours a part-time employee may work depends on their industry, and may be determined by collective bargaining.Provision of Services contracts

A Provision of Services contract is appropriate for self-employed workers or independent contractors. In this instance, the contractor provides their services for different clients, with no obligation to work for any one employer. As in many countries around the world, Portugal has a different set of guidelines for self-employed, or independent, contractors rather than employees.Some companies looking to hire a global team may prefer to hire an independent contractor, because there may be less tax liability and fewer legal requirements for that type of worker. The employer is also not obligated to provide statutory benefits for a contractor.Minimum wage and working hours for employees ⏰

As of 2022, the minimum salary in Portugal is €9,870 euros per year, and the minimum monthly salary is €822.50. The normal working period is a maximum of eight hours per day, or 40 hours per week. Work performed beyond those hours is considered overtime.Employees cannot work for more than five hours without a rest period. These rest periods must be an hour at minimum, and two hours maximum. Employees are entitled to 11 consecutive hours of rest between two consecutive work days.Collective bargaining agreements

There are three types of collective agreements in Portugal:- industry-level agreements (CCs)

- agreements covering several companies (ACs)

- agreements at the level of a single company or a workplace (AEs)

Data protection and privacy 🔐

An employee is not obligated to share anything with their employer regarding their private life, health, or pregnancy. Even if an employee's private information is absolutely necessary for the employer to assess their employee's ability to perform the job, the employer must provide a written justification for acquiring the information, and they cannot share the employee's information without the employee's consent.Discrimination

In Portugal, an employer may not discriminate against their employees on the basis of:- Parentage

- Age

- Gender

- Sexual orientation

- Marital status

- Family situation

- Genetic heritage

- Reduced work capacity

- Disability

- Chronic disease

- Nationality

- Ethnic origin

- Religion

- Political or ideological convictions

- Union affiliation

Discrimination based on gender

The Commission for Equality in Labor and Employment (CITE) is responsible for investigating any claims of discrimination or sexual harassment in the workplace. The purpose of the commission is to ensure that regardless of gender, sexual orientation, or "parentality" (i.e. whether they have children), employees are entitled to the same rights under the law. The Commission provides employee representation and consultation for workers who believe their employers are discriminating against them based on gender.Termination of an employment contract ❌

Employers may terminate an employment contract in the following circumstances:- Unlawful disobedience of orders

- Violation of the company’s employee rights and entitlements

- Repeated provocation of conflicts with colleagues

- Failure to fulfill the job's duties

- Serious damage to the company’s assets

- Falsifying justification for absences from work

- Five consecutive unjustified absences in a calendar year or 10 interspersed unjustified absences

- Unjustified absences that harm the company

- Failure to follow health and safety guidelines at work

- Engaging in physical violence or other unlawful offenses at work

- Kidnapping, or in general, any violation of freedom of the colleagues, superiors, or employer representatives

- Failure to comply with or opposition to fulfillment of judicial or administrative decisions

- Abnormal reduction in productivity

Employee benefits

There are a few standard benefits that an employee is entitled to in their employment contract, with some variation, depending on whether the employee works in the private sector. Here is a review of some of those benefits.Holiday entitlement 🏝

Employees are entitled to 22 working days of holiday per calendar year. Special rules apply for employment contracts with a duration of less than six months. If an employer requires an employee to work on a national or local municipal holiday, the working period is considered overtime work and therefore the employee must receive overtime pay. At present, 81% of Portuguese identify as Roman Catholic, so many public holidays in Portugal follow the Christian calendar, and many employers allow Sundays as a weekly rest day.At the end of the year, employees must receive a holiday bonus that is equal to a month's salary and must be paid by December 15 of each year.Sick Leave 🤒

An employee is entitled to paid sick leave, which is three days of paid leave at 100% of their normal pay. Beyond three days, Social Security pays for the sickness allowance, which allows most employees 1,095 days of paid sick leave. Those who qualify for sick leave may be entitled to 55% to 100% of their basic salary.Maternity leave and paternity leave 🤰

Female employees who are pregnant are entitled to 30 days of leave before their child's expected due date and six weeks of requisite leave following the child's birth. Fathers are entitled to paternity leave, which is 20 days, five of which must be used immediately following the child's birth. The rest of their paternity leave must be used within six weeks after the child's birth.The mother and father of the child may decide to partake in shared leave, where their leaves may total 180 days and can be taken separately or in three interim periods equal to normal working periods. The caveat is that one parent's leave parent may not overlap with the other parent's leave. The compensation for this leave is slightly below initial parental leave, at 83% their normal wages — not 100%.Leave for parents who have a child with a disability or chronic illness

If a parent has a disabled or chronically ill child and provides them with indispensable assistance, they may take leave from six months to four years. If the child is under a year old, the parent is allowed to reduce their normal working period by five hours to care for the child.Teleworking

Recently, Portugal has made the news for their progressive law that limits an employer's ability to contact staff after working hours. The new rules state that unless there is a force majeure, or some unanticipated or uncontrollable event, employers may not contact staff outside of their normal working time. What's more, employers are required to help staff pay for their home gas, electric and internet bills, and bosses are forbidden from using digital software designed to keep track of teleworkers' activities.Tax requirements 💰

An individual is considered a tax resident of Portugal if they have spent more than 183 days working in the country in a calendar year. As an employer paying your employee, you must withhold tax on a monthly basis and report income paid and tax withheld.Portuguese tax authority

The Portuguese tax year runs from January 1 to December 31, and all taxes on the previous year's income must be submitted between April 1 and June 30 to the Autoridade Tributária e Aduaneira, AT, or Tax and Customs Authority.Corporate tax requirements 🏢

Portuguese companies must pay a corporate tax. The amount a company pays depends on worldwide profits. Profits exceeding €10,000 a year, requires that the company register for Value-Added Tax, or VAT. If two or more business owners create a limited company, they must pay corporate tax.In addition to the corporate tax, the company must pay an additional fee to their local municipality.Social security contribution

Social security in Portugal covers statutory benefits such as parental leave, pensions, and unemployment benefits. In order to receive these benefits, employees at that company are required to pay 23.75% of their income in social security contributions. Companies with full-time employees must make social security contributions at a rate of 11%.Outsourcing your company's HR

There are many details to keep track of when hiring abroad, especially because compliance laws are so complex and can vary from country to country. Partnering with a company that specializes in international compliance can prevent major legal trouble and costly fines.Legal Disclaimer:

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

How Plane can help 🤝

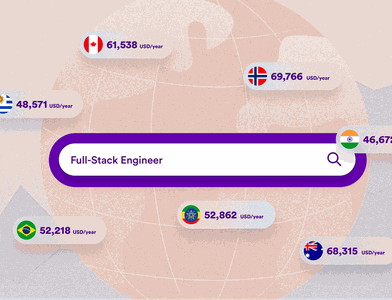

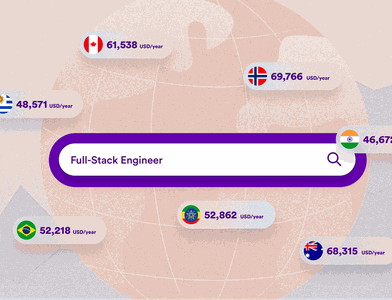

Plane can assist your company with the complexities of hiring abroad. We specialize in payroll, benefits, and compliance for remote teams. Our international and fully distributed team has expert knowledge on the essentials for hiring globally: from securing work permits, to classifying workers, to payroll, to benefits, our team has you covered.Contractors love our payroll system, too: we support payments in over 240 countries around the world, and we don't mark up exchange rates. What's more, we don't require that contractors use an e-wallet to access their funds. Unlike other payroll services, funds go straight to their bank accounts.Going global isn't daunting when you partner with Plane. 🤝

Speak with one of our experts now.

Schedule a demoRelated articles

From startups to large corporations, US companies of all sizes use Plane for global payroll, benefits and compliance.

What Is a PEO? A Guide to Its Benefits, Risks, and Alternatives

A PEO can help business owners and HR execs find and retain talent. Figure out if partnering with a PEO is right for your business with this guide.